Discuss Your Trial

Reach out to our expert team to discuss your clinical trial

Talk to IAG Specialist

Learn how our team can help you with the trial design or execution.

Frequently Asked Questions:

What is an imaging CRO and how is it different from a full service CRO or academic imaging core lab?

An imaging CRO is a specialist partner that designs, standardizes, and centrally manages all imaging aspects of a clinical trial, including image acquisition, quality control, blinded central review, and delivery of regulator‑ready imaging endpoints.

Unlike full‑service CROs or academic imaging core labs, Image Analysis Group (IAG) combines disease‑specific expert input, centralized reads, harmonized imaging protocols, quantitative imaging biomarkers, and the DYNAMIKA™ platform within a global, 21 CFR Part 11‑compliant framework to generate imaging endpoints that are sensitive to treatment effects and reproducible across sites, modalities, and large multi‑center programs.

What does an imaging core lab do in a Phase 1–3 clinical trial?

In Phase 1–3 trials, an imaging core lab designs and runs the end‑to‑end imaging strategy: protocol input, site setup and training, imaging manuals, and ongoing quality control to ensure every scan is on‑protocol and evaluable. It manages secure image transfer, anonymization, central storage, and blinded reads using predefined criteria (e.g., RECIST, RANO, RAMRIS), then delivers standardized, regulator‑ready imaging endpoints into the trial database.

Image Analysis Group (IAG) performs all of these functions via its DYNAMIKA™ platform and global expert reader network, providing centralized reads, quantitative imaging biomarkers, and real‑time oversight to support efficient decision‑making from first‑in‑human through pivotal Phase 3 studies.

What does imaging core lab does in Phase 4 trials?

In Phase 4 trials, an imaging core lab ensures that post‑marketing and real‑world imaging data are acquired and processed in a consistent, standardized way across routine clinical sites. It centrally reviews scans to assess long‑term safety, durability of response, and disease control, often using the same response criteria and quantitative measures established earlier in development.

Image Analysis Group (IAG) applies its centralized read workflows, harmonized imaging protocols, and DYNAMIKA™ platform to Phase 4 programs to generate regulator‑ready imaging endpoints enabling sponsors to explore how imaging changes translate into long‑term benefit, resource use, and patient quality of life.

When should a sponsor partner with a specialist imaging CRO instead of managing imaging in house?

Sponsors should partner with a specialist imaging CRO when imaging endpoints are central to decision‑making, when multi‑site or multi‑country standardization is required, or when complex criteria and quantitative biomarkers are needed beyond what internal teams can reliably deliver. This is particularly important for studies using advanced MRI, CT, PET, or multimodal protocols, where protocol design, centralized reads, and regulator‑ready imaging endpoints directly affect sample size, timelines, and regulatory success.

Image Analysis Group (IAG) supports these scenarios by combining vast in‑house radiology and therapeutic experts, their signature DYNAMIKA™ platform, and a global certified network to reduce variability, de‑risk go/no‑go decisions, and provide compliant, high‑quality imaging data that internal resources or non‑specialist vendors typically cannot provide.

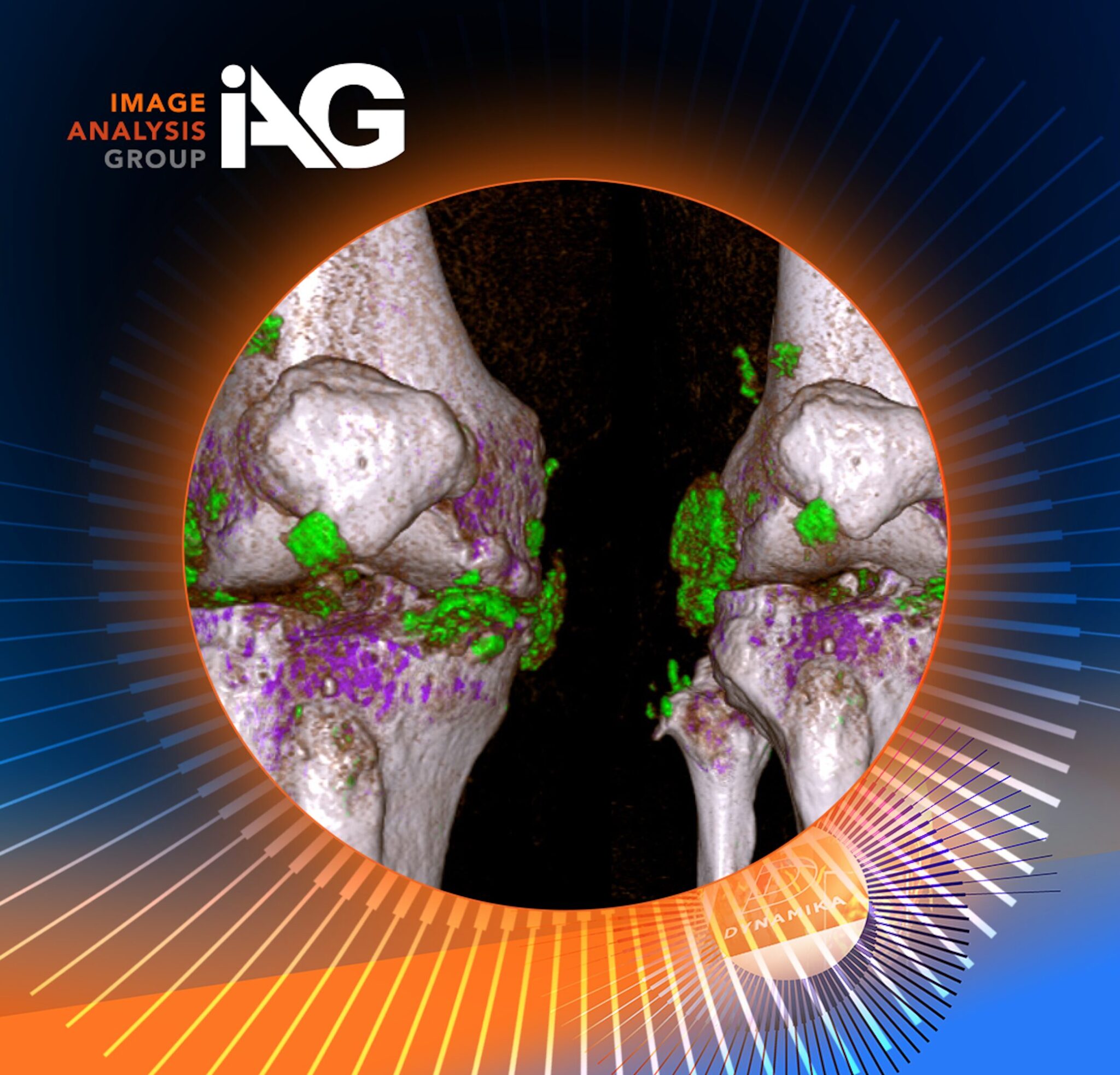

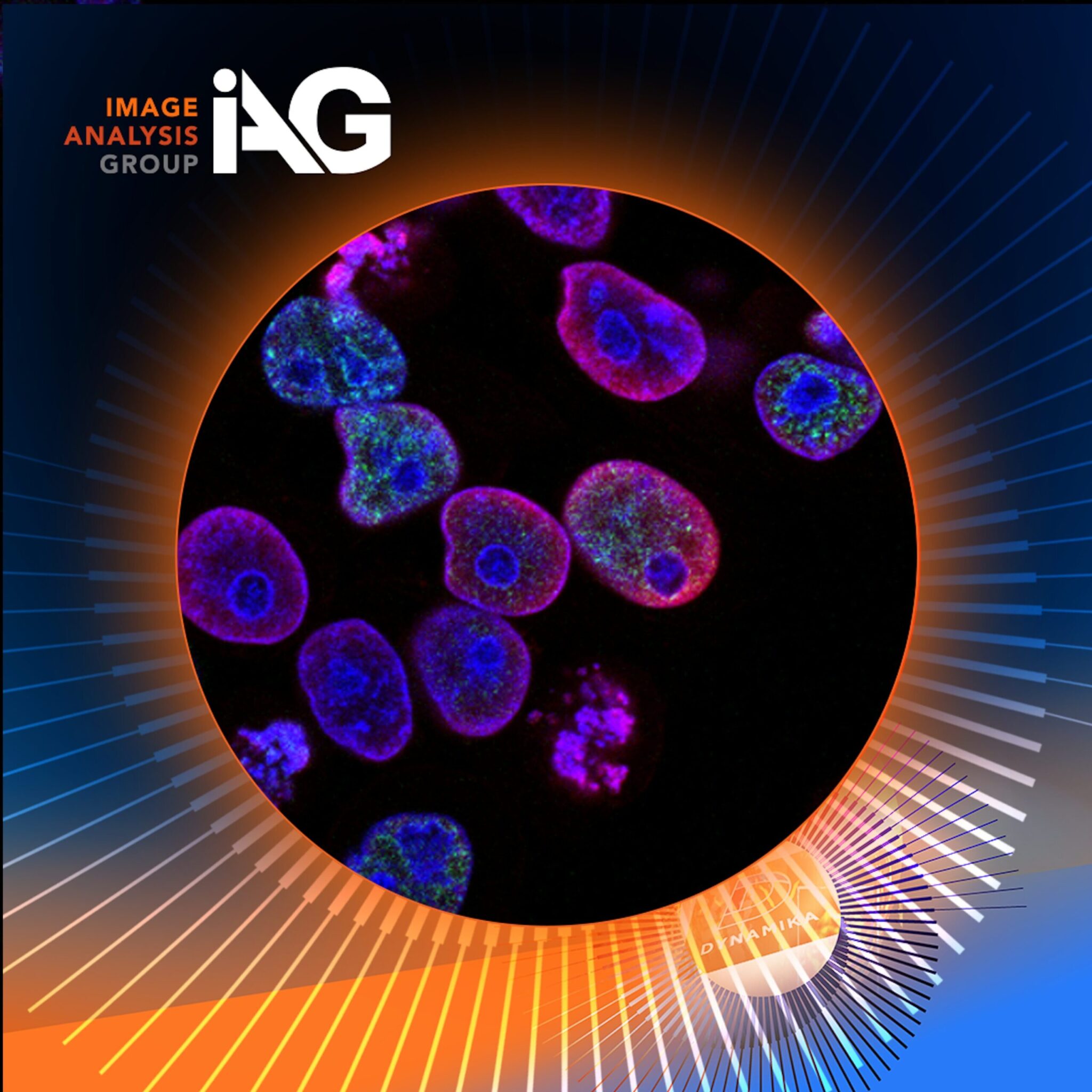

Which therapeutic areas does Image Analysis Group (IAG) support (oncology, rheumatology, obesity, NASH, rare disease)?

Image Analysis Group (IAG) supports imaging‑driven trials in: oncology and neuro‑oncology; hematologic malignancies; rheumatology and autoimmune disease; musculoskeletal and bone disorders; cardiovascular, respiratory, and infectious disease; CNS and psychiatric disease; ophthalmology and dermatology; pediatric indications; metabolic disease (obesity, diabetes, NASH/MASH and other liver diseases); and rare and genetic conditions. IAG applies disease‑specific criteria, quantitative biomarkers, and centralized reads across these areas to generate consistent, regulator‑ready imaging endpoints in both early‑ and late‑phase studies.

How do I choose the right imaging core lab for my clinical trial?

Sponsors should select an imaging core lab with proven experience in their indication, robust central read processes, and technology that can reliably deliver regulator‑ready imaging endpoints across all trial sites. Key factors include disease‑specific expertise, standardized imaging manuals and QC, 21 CFR Part 11‑compliant platforms, global reader networks, and clear governance around timelines and data quality.

Image Analysis Group (IAG) meets these criteria by combining nearly 20 years of multi‑therapeutic experience, the DYNAMIKA™ imaging platform, certified global readers, and a strong compliance framework (ISO 13485, SOC 2, FDA 21 CFR Part 11, GDPR, HIPAA) to reduce variability, support confident go/no‑go decisions, and keep imaging delivery aligned with trial milestones.

What questions should I ask an imaging CRO before awarding a study?

Sponsors should ask about indication‑specific experience, including how many trials the imaging CRO has run in the relevant disease area, phase, and modalities, and request examples of regulator‑facing work or publications. It is important to clarify central read methodology (criteria used, adjudication model, reader training), technology capabilities (21 CFR Part 11 compliance, integration with EDC/eClinical, real‑time QC), and how the vendor manages timelines, site support, and change control. Sponsors should also ask how imaging strategies can reduce sample size, de‑risk go/no‑go decisions, and support AI or quantitative biomarker development.

Image Analysis Group (IAG) routinely addresses these questions by outlining its therapeutic‑area track record, DYNAMIKA™ platform features, governance and compliance framework, and specific ways its imaging design and analytics have shortened timelines or strengthened evidence packages in similar programs.

What are the key differences between imaging CROs, central reading providers, and cloud imaging platforms?

Imaging CROs provide end‑to‑end imaging strategy, site setup, QC, central reading, and regulatory‑grade data delivery, acting as a full imaging operations partner for the trial.

Central reading providers typically focus on the read itself (reader panels, scoring criteria, adjudication) but may rely on sponsor or third‑party systems for data flow, QC, and site support.

Cloud imaging platforms mainly supply the technology for upload, storage, and viewing, but do not usually offer therapeutic‑area imaging design, reader management, or regulatory consulting.

Image Analysis Group (IAG) combines all three functions – specialist imaging CRO services, centralized expert reading, and the DYNAMIKA™ cloud platform – so sponsors gain an integrated solution rather than stitching together multiple vendors.

How can I compare imaging vendors on quality, timelines, cost, and technology?

Sponsors can compare imaging vendors by looking at four areas: quality (experience in the indication, read consistency, audit findings), timelines (startup, read turnaround, issue resolution), cost (transparency of assumptions and change‑order logic), and technology (compliance, integration, and usability).

Meaningful questions include how the vendor standardizes imaging across sites, what metrics they use for on‑time delivery and QC, how pricing scales with protocol changes or volume, and whether their platform is 21 CFR Part 11‑compliant and integrated with EDC/eClinical systems.

Image Analysis Group (IAG) supports this comparison by providing indication‑specific case examples, clear operational KPIs, transparent budget drivers, and detailed descriptions of its DYNAMIKA™ platform and compliance framework, allowing sponsors to benchmark quality, timelines, cost, and technology side by side.

What red flags should sponsors watch for when evaluating imaging vendors?

Red flags to watch for include limited or no experience in your specific indication, lack of clear standards for central reads, or an inability to describe how imaging will be standardized and quality‑controlled across sites. Sponsors should be cautious if a vendor cannot demonstrate 21 CFR Part 11‑compliant technology, relevant certifications (e.g., ISO 13485, SOC 2), or transparent metrics for timelines, query rates, and read reproducibility. Overly generic proposals, unclear assumptions behind costs, and reliance on loosely managed external readers without documented training or calibration are additional warning signs.

Image Analysis Group (IAG) addresses these risks with indication‑specific track records, a certified global network, the DYNAMIKA™ platform, and a documented compliance and governance framework that makes quality, timelines, and cost drivers explicit from the outset.

What technology platform should an imaging CRO provide for image transfer, viewing, and reporting?

An imaging CRO should provide a validated, 21 CFR Part 11‑compliant cloud platform that supports secure DICOM upload, automated anonymization, and standardized QC at the point of submission. The system should offer centralized viewing with configurable reading workflows, built‑in eCRFs, adjudication, and full audit trails, while integrating seamlessly with EDC and other eClinical tools.

Image Analysis Group (IAG) delivers this through its DYNAMIKA™ platform, which combines secure global image transfer, role‑based access, real‑time dashboards, and AI‑enabled analytics to generate consistent, regulator‑ready imaging endpoints for multi‑center trials.

What should biotechs look for in an imaging CRO versus large pharma?

Biotechs typically need an imaging CRO that can provide more hands‑on strategic input, flexible engagement models, and support for early signal detection, while large pharma often prioritizes scale, integration with internal systems, and repeatable global processes.

Smaller sponsors should look for partners who can co‑design imaging strategies, help optimize sample size and endpoints, and provide high‑touch operational support rather than just execute a predefined plan.

Image Analysis Group (IAG) is structured to support both, offering consultative design for emerging biotechs and robust, globally scalable operations and DYNAMIKA™ platform integrations that align with the governance and compliance expectations of large pharma organizations.